July 31, 2025

5 min read

@CryptoRank_io

Lemonade’s AI-powered insurance platform is poised for growth with bullish projections after its August 5 Q2 results release.

This AI Insurance Stock Could Leave Rivals in the Dust After Aug 5

AI stocks are rapidly becoming a key focus for investors as artificial intelligence integrates deeply into multiple sectors. This trend is driving firms to expand their services and investors to seek high-potential AI stocks that could transform their portfolios. Among these, one AI-powered insurance stock is gaining significant attention and is expected to surge after August 5, 2025, based on key bullish indicators.This AI Insurance Stock May Go Parabolic After August 5

Lemonade is a leading insurance company specializing in renters, homeowners, pets, life, and car insurance. The company leverages advanced AI technology through its chatbots, Maya and Jim, which handle claim requests and ensure timely payouts without human intervention. This AI-driven approach is revolutionizing the traditionally slow and cumbersome claims process, making it seamless and convenient for customers. According to Motley Fool’s analysis, Lemonade is expanding aggressively, aiming to increase the total value of premiums from outstanding policies to $10 billion over the next decade. The company is scheduled to release its Q2 financial results on August 5, which analysts believe will reinforce bullish momentum for the stock. Lemonade’s AI capabilities also include dynamic market narrative adjustments and new lifetime value (LTV) models that predict policyholder claim patterns. These models help the company forecast future claims and tailor premiums to individual policyholders more accurately."As an example, in just over a year, we went from a standing start to having comprehensively rolled out generative AI platforms to handle incoming customer communications. We handle email and text communications coming in. We’re now handling more than 30% of these interactions with absolutely no human intervention."

— Lemonade CFO Tim Bixby (source)

Lemonade Stock Projections

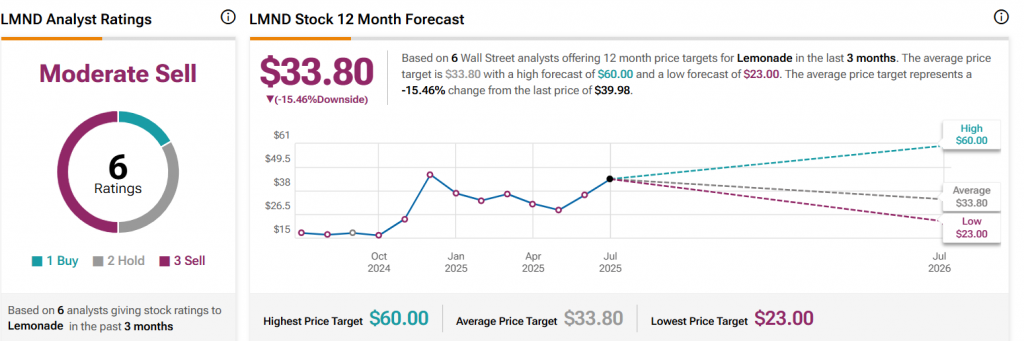

Per TipRanks, Lemonade (LMND) has the potential to reach $60 within the next 12 months. The average price target from six Wall Street analysts is $33.80, with the highest target at $60.00 and the lowest at $23.00. The current price is approximately $36.53, indicating mixed but optimistic sentiment.

Frequently Asked Questions (FAQ)

About Lemonade's AI Integration

Q: How does Lemonade use AI in its operations? A: Lemonade utilizes AI through its chatbots, Maya and Jim, to manage claim requests and process payouts with minimal human intervention. They also employ AI for dynamic market narrative adjustments and LTV models to predict policyholder claim patterns. Q: What percentage of customer interactions are handled by AI at Lemonade? A: Lemonade's CFO Tim Bixby stated that over 30% of email and text communications are handled with no human intervention, a significant increase achieved in just over a year.Financial Outlook and Projections

Q: What is Lemonade's long-term premium growth target? A: Lemonade aims to increase the total value of premiums from outstanding policies to $10 billion over the next decade. Q: What are the stock price projections for Lemonade (LMND)? A: Analyst projections vary, with TipRanks indicating a potential to reach $60 within 12 months. The average price target from six Wall Street analysts is $33.80, with a range from $23.00 to $60.00.Market Performance and Sentiment

Q: What is the current market sentiment for Lemonade stock? A: The current sentiment is described as mixed but optimistic, with analysts forecasting significant growth potential.Crypto Market AI's Take

Lemonade's strategic integration of AI into its core operations, particularly in claims processing and customer service, showcases a forward-thinking approach that aligns with the broader trend of AI adoption across industries. This technological edge can indeed be a significant differentiator, potentially allowing Lemonade to outpace competitors that are slower to adopt similar AI solutions. In the financial sector, leveraging AI for predictive modeling and operational efficiency often translates to reduced costs and enhanced customer experiences, both crucial for sustained growth. As AI continues to evolve, companies like Lemonade that are early adopters and innovators in applying these technologies to their specific markets are well-positioned to capture market share and deliver superior returns. This emphasis on AI aligns with our own platform's focus on AI-driven crypto trading strategies and market intelligence, recognizing AI's transformative power in finance.More to Read:

- Hassett: US Allows $15B Nvidia H20 Chip Sales, Orders 300K from TSMC

- Microsoft (MSFT) Nears New OpenAI Deal: MSFT to Rally?

- AI-driven Crypto Trading Tools Reshape Market Strategies in 2025

Source: Originally published at Watcher.Guru on July 30, 2025.