July 30, 2025

5 min read

@solanafloor

Orca launches Wavebreak, a no-code token creator with anti-bot features, aiming to revolutionize Solana's launchpad ecosystem.

Orca Joins Launchpad Wars with Wavebreak: What’s Different?

Solana’s fiercely competitive launchpad wars gain a new fighter from DeFi OG Orca. Orca, one of Solana’s oldest DeFi platforms, has joined Solana’s fervent launchpad wars, launching its own no-code token creator, Wavebreak, alongside rival DEXes like Raydium and pump.fun. Designed to prioritize “human traders,” Wavebreak introduces a suite of anti-bot features and innovative mechanics aimed at rewarding conviction and fostering community culture.What is Wavebreak?

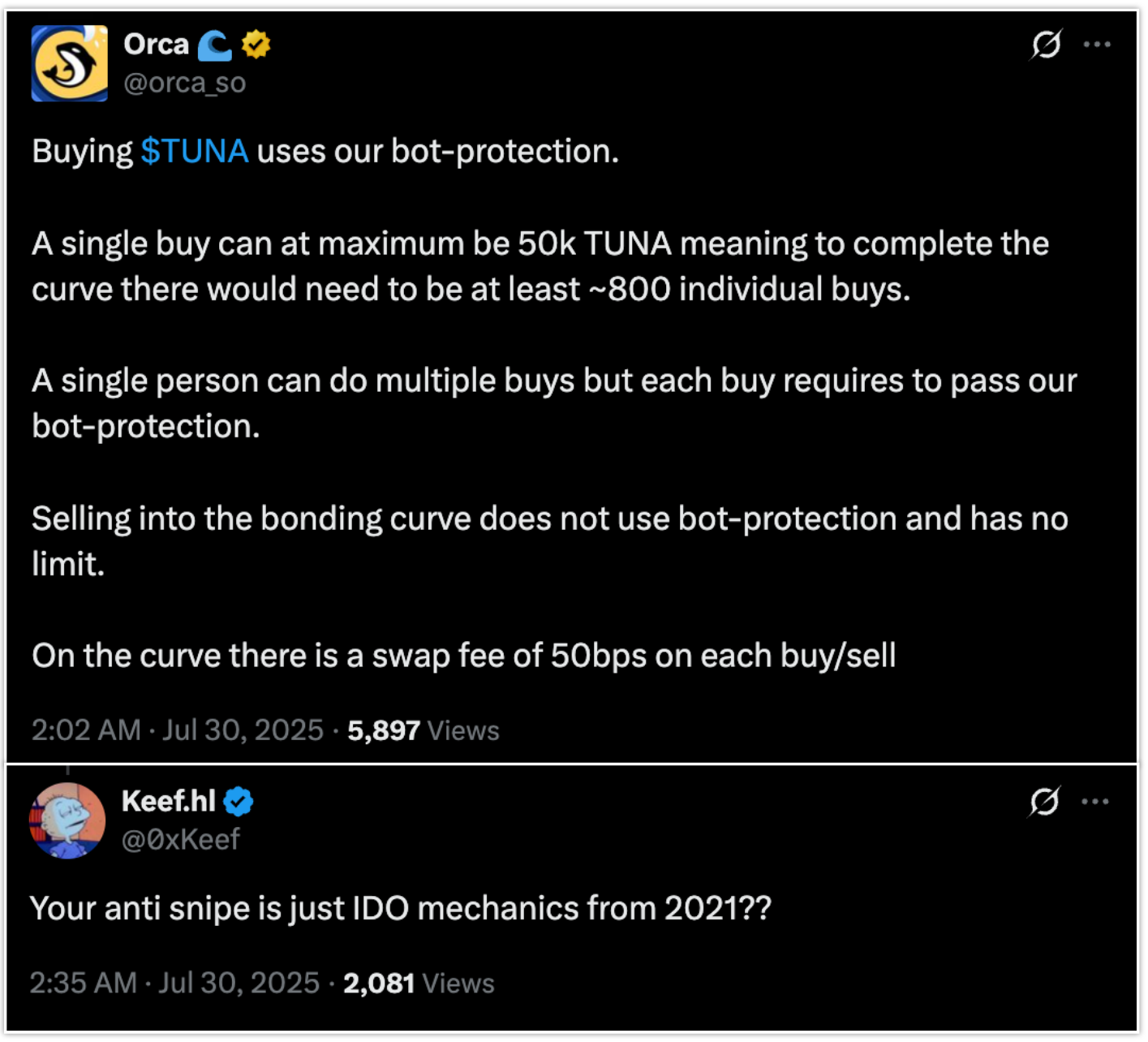

Wavebreak is Orca’s response to the challenges of botted memecoin launches, malicious sniping, and quick-flip trading culture. It offers a fairer launch mechanism that rewards long-term conviction and provides generous incentives for token creators. Similar to the model pioneered by pump.fun, Wavebreak allows traders to speculate on tokens priced via a bonding curve. When the bonding curve is fulfilled or the token reaches a market cap of 85 $SOL, it graduates to an Orca Whirlpool, becoming tradable on Orca’s DEX and external aggregators. Upon graduation, 19.32% of the token’s supply is pooled with 84 $SOL. This liquidity is locked and owned by the token creator, who receives 87% of all trading fees generated by the pool in perpetuity. While Wavebreak’s 1 $SOL graduation fee is higher than some competitors, it offers unique anti-bot mechanics designed to give all users equal access, eliminating snipers and malicious token bundles. Though Orca declined to comment on specific anti-bot measures, details from the $TUNA token launch suggest Wavebreak caps the amount of tokens purchasable in a single transaction as part of its anti-sniping suite. Despite some criticism comparing capped buys to outdated IDOs, Orca’s anti-bot architecture likely includes more sophisticated protections to safeguard human users.

To incentivize traders and maximize token distribution, Wavebreak has introduced a novel rewards mechanic: users accrue Reward Points based on daily trading volume. A portion of all graduated tokens is added to a daily rewards pool, distributed proportionally to users’ points at 8PM ET each day.

While this rewards system is engaging, it may also act as a bearish catalyst for some tokens, similar to how airdrops can dilute circulating supply.

Despite some criticism comparing capped buys to outdated IDOs, Orca’s anti-bot architecture likely includes more sophisticated protections to safeguard human users.

To incentivize traders and maximize token distribution, Wavebreak has introduced a novel rewards mechanic: users accrue Reward Points based on daily trading volume. A portion of all graduated tokens is added to a daily rewards pool, distributed proportionally to users’ points at 8PM ET each day.

While this rewards system is engaging, it may also act as a bearish catalyst for some tokens, similar to how airdrops can dilute circulating supply.

Will Wavebreak Boost $ORCA Buybacks?

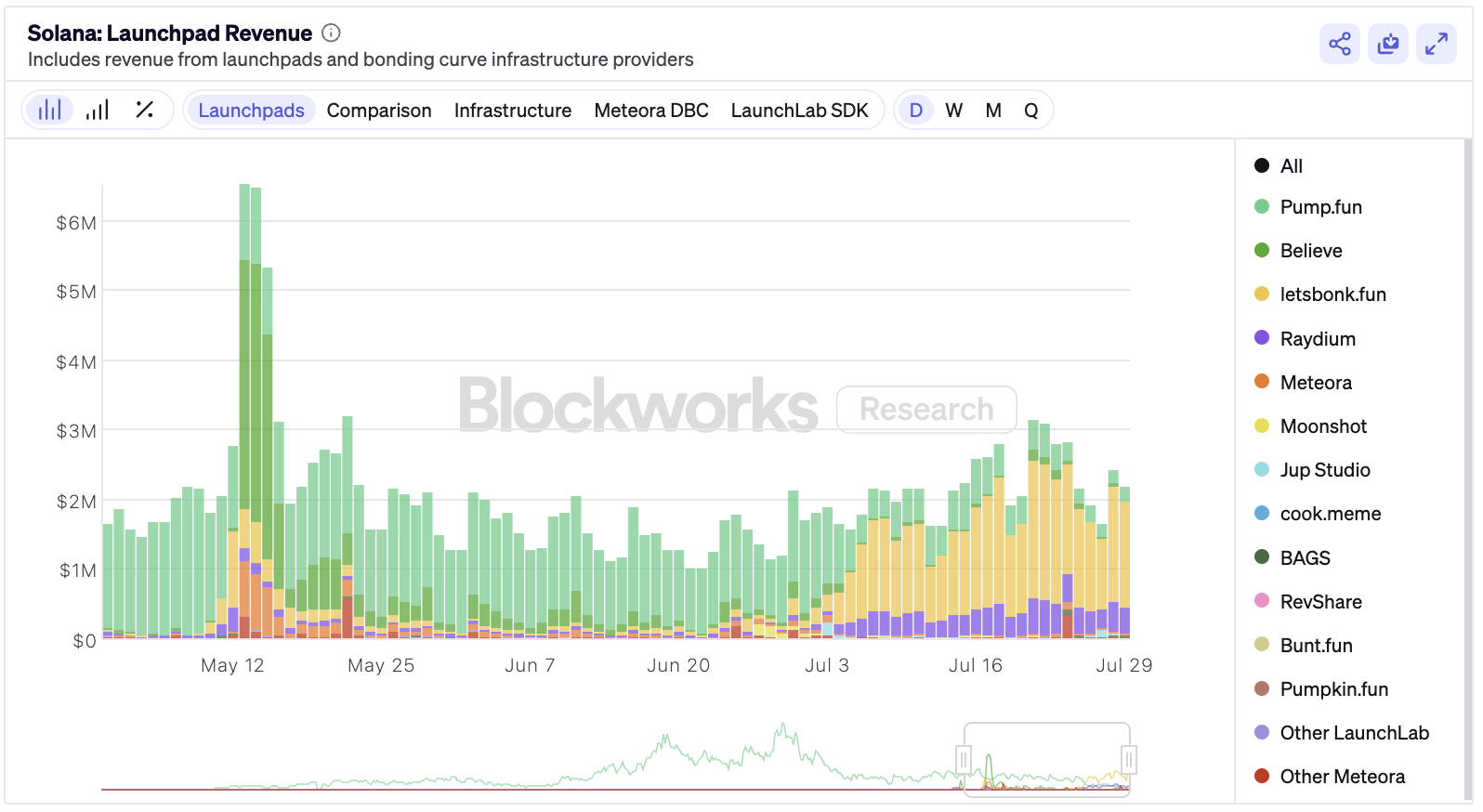

Launchpads are among the most lucrative apps in Solana’s ecosystem. At its peak, pump.fun generated millions in daily revenue, while today’s leader letsBONK averages $1.57M daily. Though Wavebreak is still proving itself, matching JUP Studio’s revenue could increase Orca’s daily token buybacks by approximately 30%. JUP Studio has averaged $22.7k daily revenue over the past week. If Wavebreak replicates this, Orca could allocate $4.5k daily to buy $ORCA tokens, based on a governance proposal directing 20% of protocol fees to buybacks.

This would represent a 30% increase over Orca’s current daily average revenue of $75.2k.

JUP Studio has averaged $22.7k daily revenue over the past week. If Wavebreak replicates this, Orca could allocate $4.5k daily to buy $ORCA tokens, based on a governance proposal directing 20% of protocol fees to buybacks.

This would represent a 30% increase over Orca’s current daily average revenue of $75.2k.

Why Does Every DEX Need a Launchpad?

As Solana’s DeFi ecosystem evolves, every decentralized exchange (DEX) must operate its own token launchpad. Pump.fun once monopolized this space, but its decision to launch its own AMM triggered a wave of DeFi apps entering the launchpad wars. DEXes now need to provide a full-stack trading venue—from token creation to optimized AMMs—to capture memecoin trading volume, a significant portion of overall DEX activity. Platforms like Axiom have demonstrated explosive revenue growth, signaling that the next frontier for launchpads will be specialized trading terminals enabling DEXes to offer a complete trading experience. If pump.fun remained the sole launchpad, PumpSwap would dominate Solana’s trading volume. Now, DEXes and their launchpads must cultivate memecoin ecosystems to stay competitive or risk losing market share and relevance.Frequently Asked Questions (FAQ)

About Wavebreak and Orca

Q: What is Wavebreak? A: Wavebreak is Orca's new no-code token creator platform designed to facilitate fairer token launches on Solana, with features aimed at combating bots and rewarding long-term holders. Q: How does Wavebreak differ from other Solana launchpads like pump.fun? A: Wavebreak introduces specific anti-bot mechanics, aims to reward "human traders" and conviction, and offers creators a perpetual 87% share of trading fees from their token's initial liquidity pool. Q: What are the benefits for token creators using Wavebreak? A: Token creators benefit from a user-friendly, no-code platform for launching their tokens, a mechanism to reward long-term holders, and a structure that provides perpetual revenue from trading fees. Q: What are the anti-bot features mentioned for Wavebreak? A: While specific details are not fully disclosed, it is suggested that Wavebreak implements measures such as capping the amount of tokens purchasable in a single transaction to prevent sniping and malicious token bundling. Q: How does Wavebreak reward traders? A: Wavebreak rewards traders through a system of accumulating Reward Points based on daily trading volume, with a portion of graduated tokens distributed daily to those with the most points.Token Launch Mechanics

Q: How are tokens launched on Wavebreak? A: Tokens are launched using a bonding curve, allowing traders to speculate. Once the curve is fulfilled or a market cap of 85 $SOL is reached, the token graduates to an Orca Whirlpool for broader trading. Q: What happens to the liquidity pool upon token graduation? A: Upon graduation, 19.32% of the token's supply is pooled with 84 $SOL. This liquidity is locked and managed by the token creator. Q: What is the graduation fee for tokens launched on Wavebreak? A: The graduation fee for tokens on Wavebreak is 1 $SOL.Potential Impact and Market Dynamics

Q: How could Wavebreak impact Orca's revenue? A: If Wavebreak achieves similar revenue to platforms like JUP Studio, it could potentially increase Orca's daily token buybacks by around 30%. Q: Why are DEXes increasingly launching their own launchpads? A: DEXes are launching launchpads to offer a full-stack trading venue, capture memecoin trading volume, and remain competitive in an evolving DeFi ecosystem where token creation is a key draw for users.Crypto Market AI's Take

Orca's entry into the launchpad arena with Wavebreak signifies a strategic move to capture a significant segment of the Solana ecosystem's activity. By focusing on "human traders" and implementing anti-bot measures, Orca is attempting to differentiate itself in a crowded market. This initiative aligns with the broader trend of decentralized exchanges offering comprehensive services, from token creation to trading. As AI continues to influence market analysis and trading strategies, platforms that can integrate these advancements while maintaining user-centric designs will likely see greater adoption. Our own platform at Crypto Market AI focuses on leveraging AI for precise market analysis and automated trading, providing tools that complement the evolving landscape of decentralized finance and token launches. The success of Wavebreak could indeed provide Orca with increased revenue streams, potentially bolstering buyback programs for its native token.More to Read:

Source: Originally published at SolanaFloor on July 30, 2025.