August 7, 2025

5 min read

@solanafloor

Orca DAO proposes staking and a 24-month buyback using and to boost protocol performance and long-term token value.

Orca DAO Proposes Deployment of 55,000 $SOL and 400,000 $USDC for Buyback Initiative

Orca DAO has introduced a governance proposal to authorize the use of treasury funds for staking $SOL into the Orca validator and launching a 24-month buyback program for the $ORCA token. If approved, the Orca Governance Council will manage up to 55,000 $SOL and $400,000 USDC from the DAO treasury to support validator operations and strategic open market purchases of $ORCA. This initiative reflects a broader shift in DAO governance toward more active financial management and long-term alignment with token holders.Proposal Objectives

The proposal outlines three main goals:- Stake treasury-held $SOL in the Orca Validator to enhance transaction propagation speed across the protocol.

- Launch a structured buyback program using treasury-held $SOL and $USDC to purchase $ORCA tokens over 24 months.

- Allocate repurchased tokens to reduce circulating supply through burns, increase xORCA rewards, or fund ecosystem grants.

- Burned to reduce supply,

- Distributed as rewards to xORCA stakers,

- Used to fund ecosystem grants. To manage risk, buybacks will pause during periods of high volatility (price swings over 15% within 24 hours). The Council will also monitor exchange rates (SOL/USD, SOL/ORCA, ORCA/USD) to optimize capital deployment. Quarterly reports detailing tokens purchased, average prices, costs, and remaining funds will be published. The DAO Buyback Program wallet address will be publicly accessible for on-chain verification.

- A minimum 4-day community discussion period,

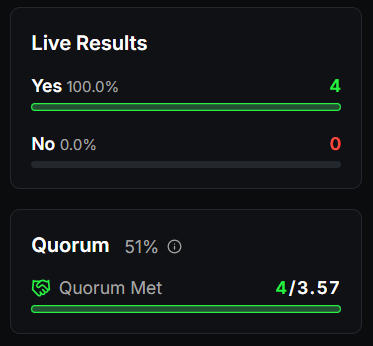

- A 5-day voting period requiring 4 Council votes for approval,

- A 2-day veto window allowing token holders to veto if 1 million $ORCA votes oppose. Voting began recently and has already secured the necessary Council approvals. If the veto threshold is not met, the Council will proceed with implementation.

- “Competition Never Ends”: Pump.fun Reclaims Top Spot Among Solana Memecoin Launchpads

- Solana Seeker Review: Is It Worth the Hype?

Overview

All $SOL in the DAO Treasury Wallet would initially be staked into a dedicated Orca Validator node optimized for Orca’s usage patterns. The Council retains the flexibility to withdraw $SOL from staking as needed to fund the buyback program. The buyback program caps daily purchases at 2% of $ORCA's 30-day average trading volume to minimize market volatility and distortion. Purchases will be executed via decentralized exchanges or partnerships with market makers. Repurchased $ORCA tokens will be held in the DAO Treasury’s multi-signature wallet and can be:Previous Context

Orca DAO initially proposed the Orca Token Revenue Share Model in March, which included using 50% of protocol fee revenue for staking rewards and potential token buybacks. Analysis by SolanaFloor Data Insights suggested that directing the entire projected $46.7 million annual revenue to buybacks could remove nearly 19.4 million $ORCA tokens annually, representing a 19.4% deflation rate. In April, Orca DAO implemented major tokenomics changes, including allocating 20% of protocol fees for weekly $ORCA buybacks, burning 25 million $ORCA tokens, and allocating $19 million USDC for core development. Additionally, $10 million was earmarked for opportunistic buybacks. The current proposal builds on this foundation by granting the Council more dynamic treasury management capabilities. Orca has also expanded its presence in the Solana ecosystem by launching Wavebreak, a no-code token deployment tool designed for retail traders with bot-resistant features and community incentives.Governance Process

The proposal was discussed at Council meetings on May 15 and July 15, 2025, receiving preliminary approval for on-chain voting. The governance process includes:

Conclusion

Orca DAO’s proposal exemplifies a growing trend among Solana DAOs to actively deploy protocol revenues and treasury assets to enhance long-term value for token holders. Similar initiatives include Jito DAO’s recent proposal to direct 100% of its fees into its treasury. By staking $SOL and initiating a structured $ORCA buyback, Orca aims to improve protocol performance, reward holders, and ensure sustainable growth.Frequently Asked Questions (FAQ)

About the Orca DAO Buyback Initiative

Q: What is the primary goal of Orca DAO's proposed buyback initiative? A: The primary goal is to utilize treasury funds for staking $SOL to enhance protocol performance and to launch a 24-month buyback program for the $ORCA token to reduce circulating supply, increase xORCA rewards, or fund ecosystem grants. Q: How much $SOL and $USDC does Orca DAO propose to use for this initiative? A: The DAO proposes to use up to 55,000 $SOL and $400,000 USDC from the DAO treasury. Q: What are the specific objectives of this proposal? A: The objectives are to stake treasury $SOL for validator enhancement, launch a structured 24-month $ORCA buyback program, and allocate repurchased tokens for burns, xORCA rewards, or ecosystem grants. Q: How will the buyback program minimize market volatility? A: Daily purchases will be capped at 2% of $ORCA's 30-day average trading volume. Q: What happens to the repurchased $ORCA tokens? A: They will be held in the DAO Treasury's multi-signature wallet and can be burned, distributed as xORCA rewards, or used for ecosystem grants. Q: Under what conditions will the buyback program pause? A: Buybacks will pause during periods of high volatility, defined as price swings over 15% within 24 hours. Q: How will Orca DAO manage risk and optimize capital deployment for the buyback? A: The Council will monitor exchange rates (SOL/USD, SOL/ORCA, ORCA/USD) and implement pauses during high volatility. Q: How will the DAO ensure transparency in the buyback program? A: Quarterly reports detailing purchases, prices, costs, and remaining funds will be published, and the DAO Buyback Program wallet address will be publicly accessible for on-chain verification. Q: What is the previous context for Orca DAO's tokenomics adjustments? A: Orca DAO previously proposed a Revenue Share Model in March and implemented major tokenomics changes in April, including allocating protocol fees for buybacks and burning a significant amount of $ORCA.Crypto Market AI's Take

Orca DAO's proposal to deploy treasury funds for staking and a structured token buyback program represents a mature approach to decentralized finance governance. By actively managing assets to enhance protocol performance and reward token holders, Orca is aligning with a broader trend seen across leading DAOs on Solana. This strategic use of capital not only aims to boost the utility and value of the $ORCA token but also demonstrates a commitment to long-term sustainability. Initiatives like this are crucial for demonstrating the evolving capabilities of DAOs in managing complex treasuries and navigating volatile market conditions. For insights into similar treasury management strategies and the broader Solana ecosystem, explore our AI-driven market analysis.More to Read:

Source: Orca DAO Proposes Deployment of 55,000 $SOL and 400,000 $USDC for Buyback Initiative