July 31, 2025

5 min read

@solanafloor

Cboe’s proposed ETF listing rules may enable Solana ETFs to gain SEC approval by September 17, streamlining crypto ETF filings.

Solana ETFs Eligible for Approval by September 17 Under Cboe’s Proposed Listing Requirements

The Chicago Board Options Exchange (Cboe) has filed a proposal to standardize crypto asset Exchange-Traded Products (ETPs), with NASDAQ and NYSE expected to follow suit soon. If accepted, these new requirements could streamline the filing process and potentially earmark Solana ETFs for approval by September 17, 2025.Six Months of Futures Trading Required for New ETFs

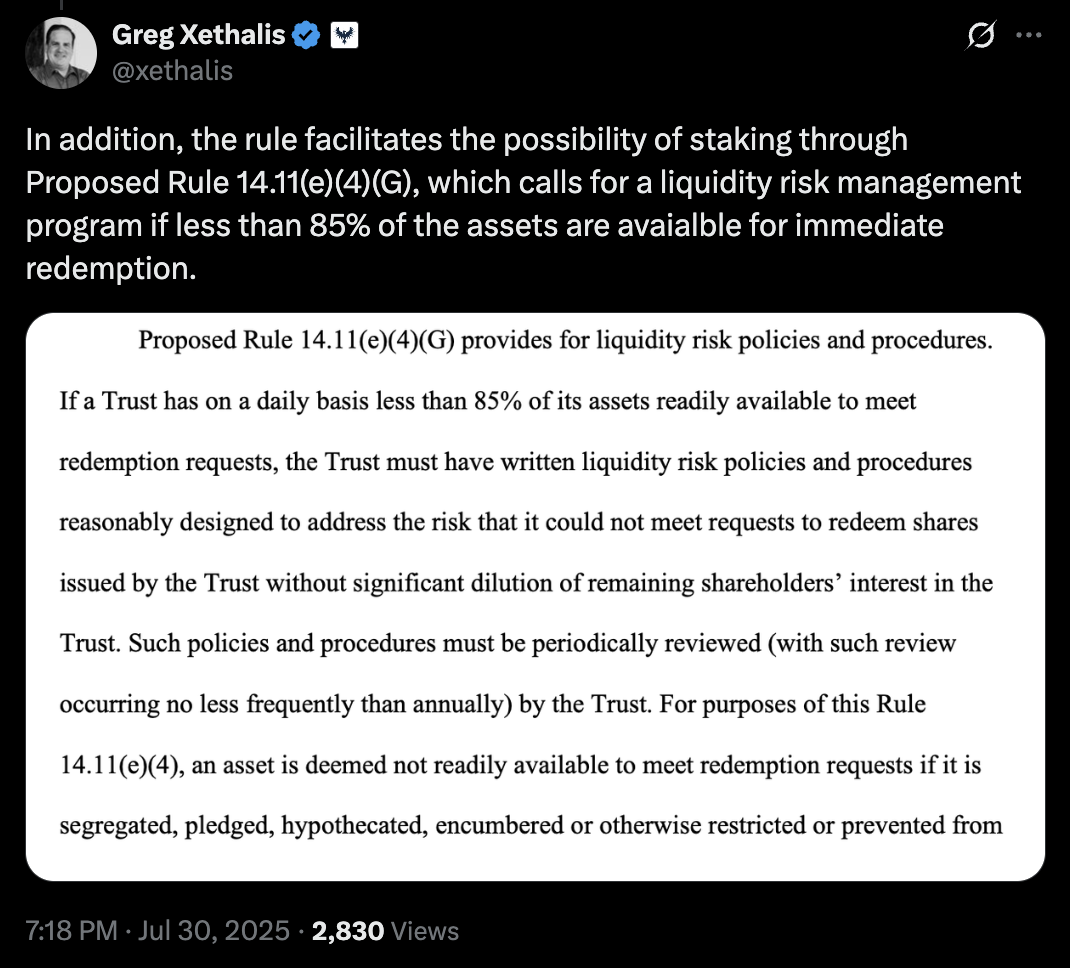

In a filing dated July 30, Cboe proposed a significant change to how crypto asset ETF filings are processed by the U.S. Securities and Exchange Commission (SEC). The new rule would allow an issuer’s shares to be listed if the underlying commodity has been traded on a U.S. exchange via a futures contract for at least six months. Bloomberg ETF Analyst James Seyfartt asserted that this ruling effectively “outsources the decision making for which digital assets will be allowed in an ETF wrapper” to the Commodity Futures Trading Commission (CFTC), which approves futures contracts. This standardization shifts the responsibility from the SEC to the CFTC for determining eligible crypto assets.Multicoin Capital General Counsel Greg Xethalis noted the proposal also supports the inclusion of staking in future crypto ETFs. Specifically, issuers must have written liquidity risk policies if less than 85% of their assets are readily redeemable.

Given that natively-staked $SOL has a 2-3 day unstaking period, this requirement aims to protect investors from illiquid redemption risks. The ruling favors staking providers such as Marinade Finance, which plans to offer instant unstaking on native $SOL, potentially becoming a vital part of liquidity risk policies.

Given that natively-staked $SOL has a 2-3 day unstaking period, this requirement aims to protect investors from illiquid redemption risks. The ruling favors staking providers such as Marinade Finance, which plans to offer instant unstaking on native $SOL, potentially becoming a vital part of liquidity risk policies.

$SOL ETF Approvals Expected in September?

Cboe’s filing is expected to be submitted to the Federal Register this week, triggering a 21-day comment and review period. If approved, the rule would establish a clear timeline for Solana ETF approvals. Under the new rule, the underlying assets in prospective crypto ETFs must have been available as futures contracts for six months before approval. Since Solana futures contracts launched on March 17, 2025, the earliest possible Solana ETF listing date would be September 17, 2025. Currently, the SEC’s soft deadline for Solana ETF approvals is October 10, 2025. If Cboe’s proposal is accepted, the nine prospective Solana ETFs could be approved between September 17 and October 10, 2025.Solana Ecosystem Leaders Advocate for Liquid Staking Tokens (LSTs)

Addressing liquidity and redemption concerns, prominent Solana ecosystem figures submitted a public letter to the SEC advocating for Liquid Staking Tokens (LSTs). LSTs enable holders to earn staking rewards without the risks associated with unstaking periods. If Cboe’s proposed rule change passes, LSTs like $jitoSOL could help meet the requirement that 85% of assets be readily redeemable. $jitoSOL, Solana’s largest LST by market cap, is currently part of REX-Osprey’s Solana Staking ETF, $SSK.Read More on SolanaFloor

- Orca Joins Launchpad Wars with Wavebreak: What’s Different?

- Orca Joins Launchpad Wars with Wavebreak: What’s Different?

- Could Solana ETF Inflows Reach $5B?

Could Solana ETF Inflows Reach $5B?

Source: SolanaFloor